How to Stop Foreclosure Days Before the Auction

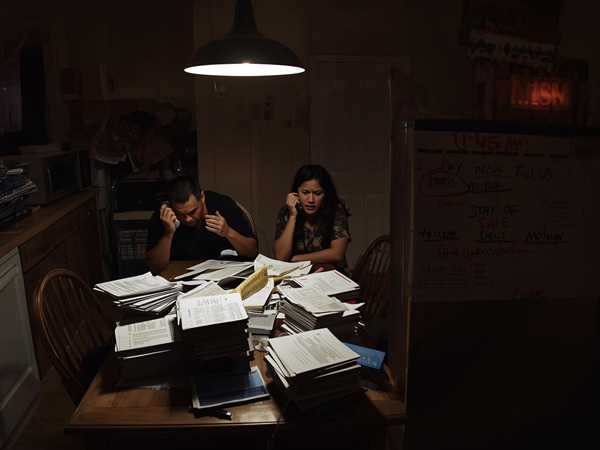

Urgent, Last-Minute Options When Time is Running Out

⚠️ ACT IMMEDIATELY: Your foreclosure auction clock is ticking. These options require urgent action.

🚨 IMMEDIATE ACTIONS REQUIRED

📞 Call Your Servicer NOW

Request reinstatement amount, sale postponement, or payoff quote. Get everything in writing.

⚖️ Consult an Attorney TODAY

Emergency bankruptcy filing or TRO can stop auction. Time-sensitive legal options available.

💰 Secure Emergency Funds

Explore bridge loans, 401(k) loans, family help, or local assistance programs immediately.

Key Takeaways: Last-Minute Foreclosure Defense

📋 Document & Deadline Checklist

- Gather Notice of Default & Sale immediately

- Mark exact auction date on calendar

- Prepare hardship letter with proof

- Organize payment history and tax returns

⚡ Emergency Legal Actions

- Bankruptcy filing triggers automatic stay

- Temporary Restraining Order (TRO) options

- Chapter 13 vs Chapter 7 considerations

- Attorney consultation required immediately

💵 Financial Solutions

- Bridge loans & hard-money lenders

- State/local emergency assistance

- Loan reinstatement calculations

- Forbearance negotiation strategies

📞 Who to Contact FIRST (In This Order)

Lender/Servicer

Ask for: Loss mitigation department, exact cure amount, written postponement

📝 Get case ID & rep name

HUD Counselor

Hotline: 1-800-569-4287

Free, documented guidance & application help

🆓 FREE government service

Foreclosure Attorney

Emergency consultations available

Can file TRO or bankruptcy same day

⚖️ Same-day filings possible

⚖️ EMERGENCY LEGAL REMEDIES

Temporary Restraining Order (TRO)

- Timeframe: File within 24-48 hours before sale

- Duration: Typically 7-14 day stay

- Requires: Evidence of irreparable harm

- Cost: Attorney fees + filing fees

Bankruptcy Automatic Stay

Chapter 13: Repayment plan (3-5 years)

Chapter 7: Immediate stay but may lose home

Filing Fee: $313-$338

💰 LAST-MINUTE FINANCIAL FIXES

Quick Funding Sources

| Source | Time | Cost |

|---|---|---|

| Bridge Loan | 24-72 hrs | 8-18% APR |

| Hard Money | 1-3 days | 10-25% APR |

| 401(k) Loan | 3-7 days | 4-8% APR |

Emergency Assistance Programs

• State/local grants: $3,000-$50,000

• HUD-approved agency help

• Income-based eligibility

🏡 Rapid Exit Options When Time Runs Out

Short Sale

Timeline: 30-120 days

Requires: Lender approval

Credit Impact: Less severe than foreclosure

Key: Get deficiency waiver in writing

Deed-in-Lieu

Timeline: 2-6 weeks

Requires: No junior liens

Benefit: Cleaner exit than foreclosure

Key: Vacate property as agreed

🚀 Quick Cash Sale to Investor

Timeline: 7-14 DAYS

Benefit: Avoids foreclosure on record

Process: As-is purchase, no repairs needed

Solution: Fast closing, clear debt, move forward

Learn About Cash Sales →❌ CRITICAL MISTAKES THAT DERAIL LAST-MINUTE EFFORTS

One missed filing or payment window can eliminate all options

Get EVERYTHING in writing—servicer agreements, postponements, offers

Avoid foreclosure rescue scams. Use licensed attorneys or HUD counselors

Need Immediate Solutions in Massachusetts?

If you're out of time and need a guaranteed exit strategy, explore these options:

Disclaimer: This guide provides general information about last-minute foreclosure options. It does not constitute legal or financial advice. Consult with a qualified foreclosure defense attorney and financial advisor about your specific situation. Time-sensitive legal and financial actions have serious consequences—professional guidance is essential.