HomeVestors in Boston Reviews (2026): The Truth About "We Buy Ugly Houses"

Reviews show 78% of Boston sellers received a cash offer within 14 days, but that number doesn't tell the whole story. If you're selling a dump or a tired rental you'll love the fast, no-repair cash closings, they move quick and you won't chase contractors, but you've also got to watch for lowball offers and tight fine print that can shave your payout. So, is it worth it? It depends on your timeline and tolerance for risk.

Key Takeaways:

- Offers often land 10-30% under market value. That’s what a lot of Boston sellers report, especially when the house needs work - so if you want convenience you’ll probably pay for it. Expect a lower cash price.

- Cash offers and closings in as little as 7-14 days are commonly reported. Want out fast? They’ll move quick, no doubt, but speed usually comes with trade-offs - less negotiation time, less chance to shop around.

- Properties needing major repairs typically see discounts of 20% or more. If the roof, plumbing or foundation’s shot, don’t be shocked by the haircut - they’re buying for a flip, not to put you in a renovated home.

- Service and offer quality varies by franchise operator - some Boston teams get solid local thumbs up, others get slammed. So the person across the table matters big time, try to meet them, compare offers.

- Online reviews are mixed, roughly split between positive fast-sale stories and complaints about low offers or poor communication. Read the fine print, check references, and don’t sign anything without knowing the final numbers.

What’s the Buzz About HomeVestors in Boston?

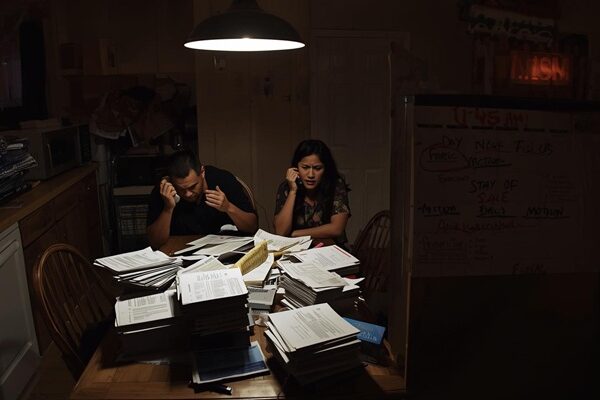

You’re standing in a cramped, sunless basement unit in Dorchester that you inherited and thinking fast cash would be amazing - that’s the exact situation where HomeVestors’ name pops up everywhere. Across Boston you’ll see their trucks, their billboards and the familiar “We Buy Ugly Houses” ads on repeat, and for many sellers that visibility translates into a quick, straightforward transaction: fast closings, no repairs, and cash in hand in a matter of days instead of months.

But there’s always a trade-off. In neighborhoods like Jamaica Plain or South Boston sellers regularly tell me they got offers that traded speed for price - often meaning you accept below-market offers to avoid the hassle of listing, inspections and showings. If you’ve got liens, probate issues, or an urgent timeline, that convenience can be worth it - if you can stomach the discount. For a different approach focused on fairness and transparency, you might explore how a local home buying process can work.

What Homeowners Are Actually Saying

You pull up Google, Yelp and the BBB and you’ll find glowing 5-star notes about painless closings right next to one-star rants about low offers and aggressive sales tactics. Positive reviews usually highlight almost-instant offers and waived repairs - sellers with inherited properties or major deferred maintenance repeatedly praise the simplicity - speed and convenience praised.

You’ll also see a steady stream of complaints. People who listed their place on the open market later say they could’ve netted far more money; others mention surprise adjustments during escrow or pressure to sign quickly. The pattern is clear: many sellers get great service for fast, messy houses, while others end up feeling they left serious money on the table - you can lose tens of thousands compared to a full retail sale in some cases.

If you’re in a situation like probate, foreclosure threat, or a job relocation and can’t wait, you should get more than one cash offer and, if possible, a quick appraisal or CMA so you know how much of a haircut you’re taking. Ask each buyer for an itemized offer, check for hidden fees, and consider consulting a real estate attorney - get a comparative market analysis or appraisal before you sign anything.

Is It Really As Easy As They Say?

They make it look like a no-brainer, but it’s rarely that simple. You can sell fast - I’ve seen cash closes in as little as 7 days and most franchises aim for 7-30 days - and you’ll typically avoid the 5-6% realtor commission, which is a big win. But in Boston you’re dealing with high rehab costs and picky comps; in my experience offers often land roughly 10-25% below comparable market value once the buyer factors in rehab, holding costs, permits and their profit margin.

And while the paperwork is less than a traditional sale, there’s still a title search, municipal liens and closing formalities that can slow things down or reduce your net. So if you want the speed, be ready to accept a price that reflects uncertainty and the buyer’s built-in margin - you’re trading convenience for cash and speed. To understand what a transparent, local alternative looks like, check out the story behind a locally-focused home buying company.

Are There Any Hidden Fees or Surprises?

Yes - the real surprises aren’t “fees” from the franchise so much as third-party liabilities that come out of your proceeds: municipal liens, unpaid property taxes, utility bills, and code violations are common in older Boston homes and can be deducted at closing. Those items can run from a few hundred dollars up to several thousand, and I’ve seen a single outstanding water lien of $3,200 wiped off a seller’s check at closing.

And while you won’t pay an agent commission, that doesn’t mean the offer isn’t padded for profit - most buyers build a margin into the number they give you, effectively replacing the commission with a deeper discount. Sometimes buyers will ask sellers to cover specific closing costs or sign addendums shifting small fees your way - I’ve encountered sellers agreeing to pay $1,000-$2,000 for unpaid municipal charges to keep a quick close on track.

So protect yourself: get a title search, ask for a line-item net proceeds sheet, and have an attorney or trusted real estate advisor review any addendum - legal review fees in Massachusetts typically run between $500 and $1,500, and spending that can save you thousands if liens or surprises show up. Demand transparency in writing, and don’t sign blind just for speed. For a straightforward consultation on your specific property, reach out to a local expert for a no-obligation chat.

The Pros and Cons - Let’s Keep It Real

| Pros | Cons |

|---|---|

| Speedy closings - HomeVestors often advertises closings in as little as 7 days. | Lower offers - many sellers get bids that are well below retail market value. |

| Sell “as-is” so you avoid paying for repairs or staging. | Opaque valuation - offers can feel arbitrary unless you push for comps. |

| Certainty - fewer fall-throughs compared with some retail buyers. | Fees and markups - rehab costs and wholesale margins are baked into the offer. |

| Convenience - one point of contact handles paperwork and coordination. | Limited upside - you give up potential profit if the house could sell for more on the open market. |

| Good for complicated situations - probate, inherited homes, or liens. | Not always transparent about who the ultimate buyer or investor is. |

How Do They Stack Up Against the Competition?

Many people assume every cash buyer behaves the same - you'll get a fast, fair offer and be done. In reality, HomeVestors operates as a nationwide franchise network with about 1,100+ local buyers, which means offers tend to be more standardized and predictable than solo flippers but still notably lower than retail market value. You can expect a HomeVestors offer typically in the range of 10-35% below comparable MLS after-repair value, depending on property condition - whereas algorithmic iBuyers (like Opendoor-style models) often price you closer to market but charge around 5-10% in fees, and local investors vary wildly: some will outbid HomeVestors on price, others will undercut them or fall through on financing.

| Feature | HomeVestors vs Other Cash Buyers |

|---|---|

| Offer pricing | Generally 10-35% below ARV; iBuyers closer to market but with fees; local buyers vary. |

| Speed to close | Fast - typically 7-30 days; comparable to other cash buyers and faster than traditional MLS. |

| Transparency & contracts | Standardized franchise contracts and processes - more predictable than solo buyers but less negotiation room. |

| Local market nuance | Decent - local franchisees know markets, but may rely on franchisor pricing models; hyper-local investors sometimes have an edge. |

Seriously, Should You Sell to HomeVestors?

Factors to Consider Before You Jump In

A neighbor of mine in Jamaica Plain took a cash offer from a national buyer last spring after his basement flooded and he needed out fast - no repairs, no staging, no months of showings. You get that kind of speed with HomeVestors: they’ll typically move from walkthrough to offer in a few days and close in as little as 7-14 days if you want, which is huge when you need to be somewhere else or avoid ongoing mortgage and tax bills.

- Cash offer speed vs potential lower price

- As-is sale - you don't pay for repairs or contractors

- Closing timeline flexibility - often much faster than MLS

- Broker commission savings vs company service fees or concessions

- Rehab estimate - they price in repair costs, so expect discounts to market

- Local MA market conditions - Boston neighborhoods with hot comps narrow the discount

The final trade-off you weigh is speed and certainty against how much of your home's equity you're willing to give up. If you're exploring options for a fast house sale in Boston, it's crucial to understand all your avenues.

When It Might Not Be the Best Choice

A cousin of mine sold a Tudor in Brookline last year and took an all-cash shortcut because she hated the parade of strangers - she closed in two weeks with no repairs, but later learned comparable MLS sales were 20-30% higher in net proceeds after fees. If your place is in decent shape, near transit, or in a neighborhood with strong comps, you might leave a lot of money on the table with a typical investor offer.

And if you're not under a hard deadline - maybe you're able to hold for two or three months - listing with an agent or doing selective repairs often nets significantly more; in Boston, investors commonly deduct 10-25% for rehab and risk, so a $600,000 place could get $60k-150k more on market. Also watch out for title or legal encumbrances: investors can handle messy titles but will discount for that risk - which means you get less. If avoiding hassle and getting fast cash is your priority, it makes sense; if maximizing proceeds matters more, you should probably explore the MLS route first. To get a clearer picture of your home's potential cash value, consider using a free, no-obligation offer calculator as a starting point.

To Wrap Up

Drawing together all the local buzz, you might think HomeVestors in Boston just swing by, lowball you and disappear with your keys - but that's not the whole picture. You get fast offers, and that works if you need speed, but you also need to vet each local office, compare comps, and treat their pitch like any other buyer's offer; don't let the catchy "We Buy Ugly Houses" line gloss over the details. Want the best outcome? Don't sign on blind; push for the numbers and read the fine print, and yeah, trust your gut.

So when you're deciding, do the math on repairs, holding costs and taxes, and then see if the convenience is worth the haircut. Know your bottom line. Ask for references and get everything in writing - walking away is always an option if it doesn't add up, and you'll feel better for having done your homework.

Remember, Greater Boston is a diverse market. Whether your property is in Boston proper, Essex, or Tewksbury, local market conditions can significantly impact your offer and experience.