The Hidden Costs of Selling a Home in Boston (And How a Cash Sale Avoids Them)

When you decide to sell your house, you probably have a "magic number" in your head. Maybe you see that homes in Dorchester or Roslindale are listing for $650,000, so you assume that is what will land in your bank account.

Unfortunately, the "Sale Price" and your "Net Proceeds" are two very different numbers.

Between the Massachusetts "Tax Stamps," attorney fees (because yes, MA is an attorney state), and mandatory inspections, selling a home here is expensive. For many sellers, these "hidden" costs can eat up 8% to 10% of the final sale price.

⚠️ Before you list, you need to know exactly what comes out of your check at the closing table.

The 6 Hidden Costs of Selling Your Boston Home

1. The Big One: Agent Commissions (~5-6%)

This is the most obvious cost, but it still stings the most. In a standard Boston real estate transaction, the seller pays the commission for both their own agent and the buyer's agent.

The Cost: Typically 5% to 6% of the sale price.

The Math: On a $600,000 home, that is $30,000 to $36,000 gone immediately.

2. Massachusetts Tax Stamps (Transfer Tax)

Many first-time sellers are shocked by this one. Massachusetts charges an excise tax on the sale of real estate. It is technically called a "Deed Excise," but everyone calls it "Tax Stamps."

The Cost: In most counties (including Suffolk), the rate is $4.56 per $1,000 of the sale price.

The Math: If you sell your home for $600,000, you owe the state $2,736. This must be paid at the Registry of Deeds before the sale is recorded.

Note: If you are in Barnstable County, the rate is higher due to the Cape Cod land bank fee.

3. Seller's Attorney Fees

Massachusetts is an "Attorney State." Unlike other states where a title company handles everything, here you almost certainly need a real estate attorney to draft the deed and represent you at closing.

The Cost: A flat fee usually ranging from $800 to $1,500, depending on the complexity of the title.

4. Smoke & Carbon Monoxide Certificate

You cannot legally close on a house in Massachusetts without a certificate from the local Fire Department proving your detectors are up to code (per MGL Ch. 148 Sec. 26F).

The Cost:

- Inspection Fee: $50 for a single-family, $100 for a two-family (payable to the Fire Dept).

- Equipment Costs: If your detectors are older than 10 years, you must replace them. A hardwired system for a 3-bedroom colonial can easily cost $300–$500 in parts and electrician labor.

5. The "Market Ready" Costs (Staging & Repairs)

To get top dollar on the MLS, you can't sell a house with peeling paint or 1970s carpets. Boston buyers are picky.

Staging: Professional staging in Boston typically starts at $2,500 for a basic package and goes up to 1-3% of the list price for luxury homes.

Mandatory Repairs: If the buyer's home inspector finds knob-and-tube wiring or a roof near the end of its life, you will likely be forced to credit the buyer $5,000–$15,000 to keep the deal alive.

6. Recording Fees

These are small fees paid to the Registry of Deeds to record the paperwork.

The Cost: Roughly $155 to record the deed and $105 to record the "Mortgage Discharge" (proof you paid off your loan).

The Real Numbers: Traditional vs. Cash Sale

Let's look at a hypothetical sale of a Boston home to see how the numbers actually shake out.

| Item | Traditional Listing ($600k Sale) | Cash Sale Offer ($550k Offer) |

|---|---|---|

| Sale Price | $600,000 | $550,000 |

| Realtor Commission (5%) | -$30,000 | $0 |

| MA Tax Stamps | -$2,736 | $0 (We often pay this) |

| Attorney Fees | -$1,200 | $0 (We pay ours) |

| Staging / Prep | -$2,500 | $0 |

| Repairs / Credits | -$10,000 (Avg) | $0 |

| Holding Costs (3 mos) | -$9,000 (Mortgage/Tax/Util) | $0 |

| NET TO SELLER | $544,564 | $550,000 |

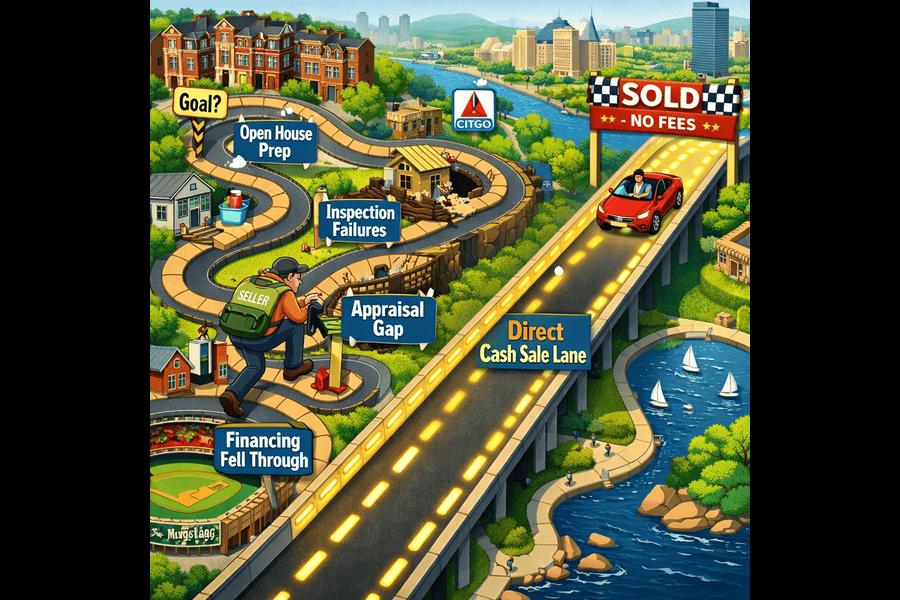

The "Lowball" Myth

As you can see, a cash offer that looks lower on paper might actually put more money in your pocket because it eliminates the friction costs of selling.

How a Cash Sale Saves You Money

When you sell to us:

💰 No Commissions

You save that 5-6% immediately. We're direct buyers, not agents charging commissions.

🏛️ We Pay Closing Costs

In many cases, we cover the transfer tax and attorney fees for you.

🔨 No Repairs

We buy "As-Is," so you don't spend a dime on contractors or mandatory upgrades.

⚡ Fast Closing

Close in as little as 7-21 days, saving you months of mortgage payments and utilities.

✅ No Financing Risk

Cash offers don't fall through due to bank appraisals or mortgage denials.

🏠 Sell in Any Condition

Leave behind furniture, clutter, or even minor damage. We handle everything.

Learn More About Selling Your Boston Home

Stop Worrying About the Fees and Start Planning Your Move

Contact us today for a net-to-seller cash offer. We'll show you exactly what you'll walk away with—down to the penny. Compare it against what an agent tells you, and make the choice that's best for your family.

Get My Net Cash OfferNo Obligation • No Commissions • No Hidden Fees